|

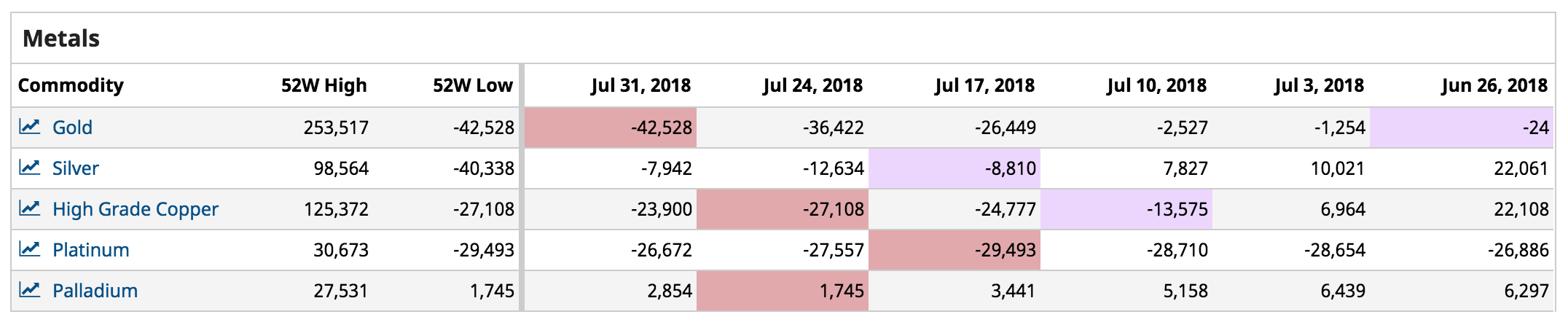

I'm watching Gold this week as extreme negative sentiment could lead to a short-term bounce in the precious metal price. Net positioning in managed money (hedge funds and other professional investors) is at an all-time low in Gold, which means that short positions could start to unwind. Rising support from oversold levels were registered in small-cap gold miners (ETF: GDX), and Newmont Mining (NEM). Market uncertainty could trigger a safety bid this week, with the CBOE VIX Index still holding above 11.50 and the Japanese Yen (ETF: FXY) displaying a similar support pattern to gold ETFs. USD/JPY will need to confirm downside towards 110 to confirm support for the gold price.

|

AuthorDamanick Dantes, CMT ArchivesCategories |

RSS Feed

RSS Feed