|

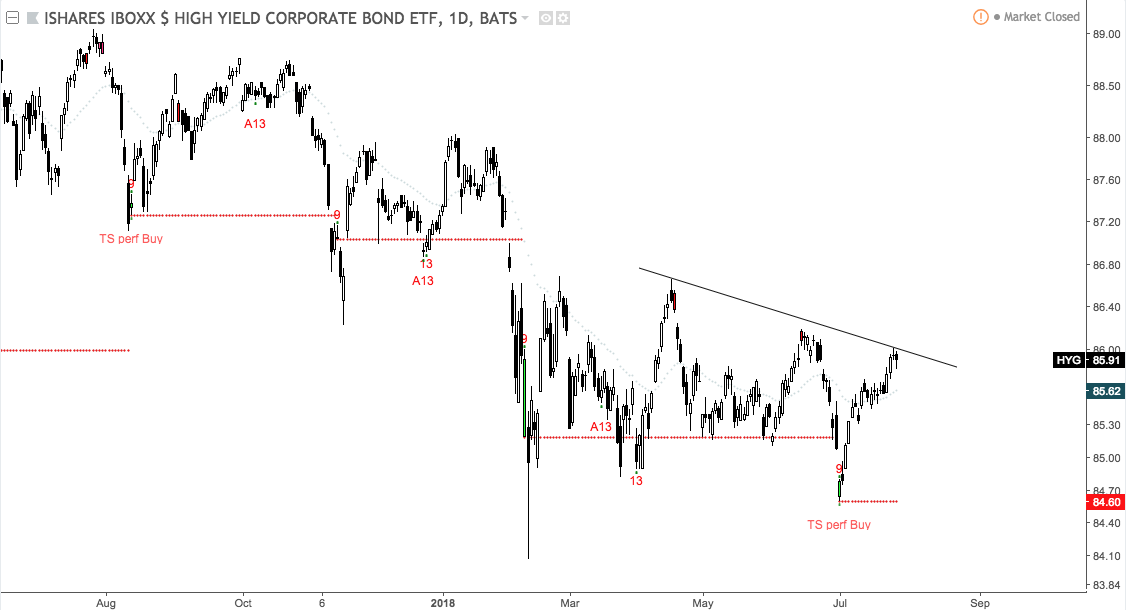

The CBOE VIX Index, a measure of market volatility, found a base of support around the 11.40 level, which sets a bearish tone to start the week. Initial downside support for the S&P 500 is around 2,790, especially as overbought signals emerge for the Russell 2,000 Small-Cap Index. Downtrend resistance is apparent in the MSCI Emerging Market Equity ETF (EEM) and High Yield ETF (HYG). US Financials also look stretched, with overbought signals in Berkshire Hathaway (BERK.B), the Financial Sector ETF (XLF)'s second-highest weighting. Expect a drift lower in the US 10-year Treasury Yield, together with slowing momentum in the US Dollar.

|

AuthorDamanick Dantes, CMT ArchivesCategories |

RSS Feed

RSS Feed