|

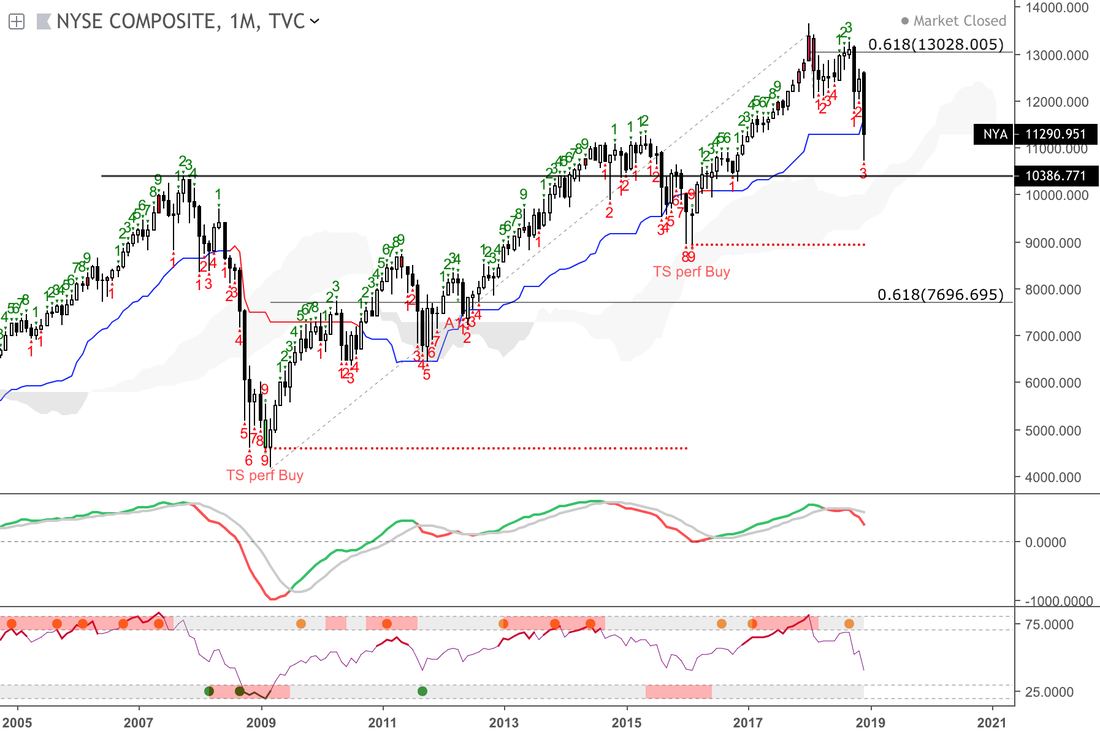

When two years of accelerated buying activity suddenly halts, all investors should pay attention. That's the case with the NYSE Composite, which includes more than 1,900 stocks including foreign listings. The NYSE Composite registered upside price exhaustions on four occasions over the past market cycle beginning around 2008, and at each exhaustion price momentum decelerated ahead of significant corrections. This time, a strong level of support is nearby which could mark a price low, but not necessarily the low for stocks. International equities like China register better long-term price lows, which could attract greater money flow relative to U.S. equities during a coming relief rally. However, the decline in momentum since 2014 despite new price highs in the NYSE Composite earlier this year warrants caution for 2019. |

AuthorDamanick Dantes, CMT Archives |

RSS Feed

RSS Feed