|

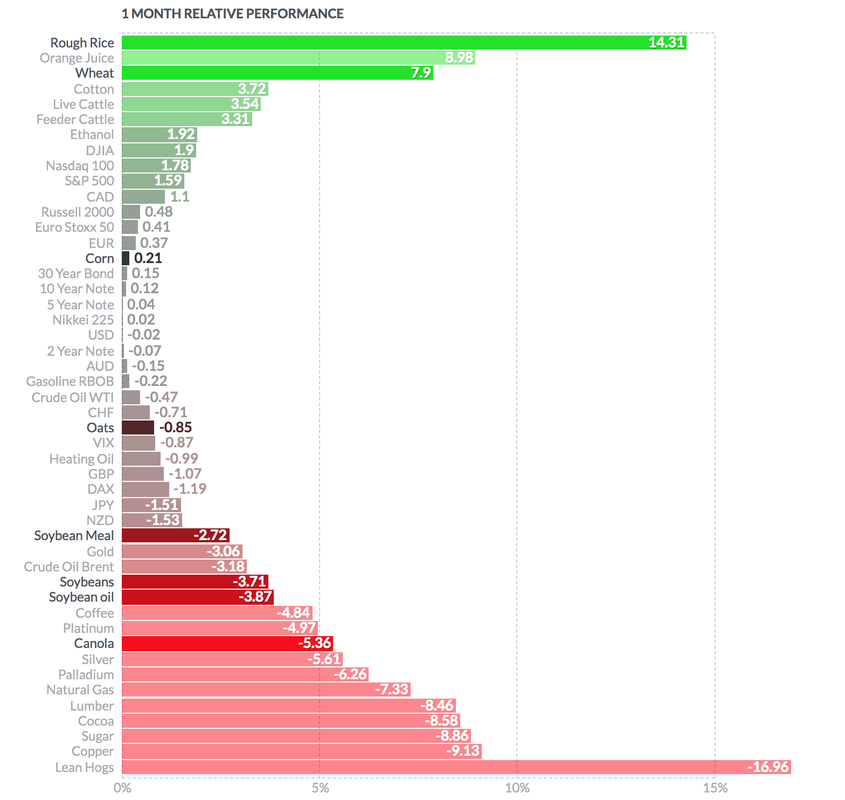

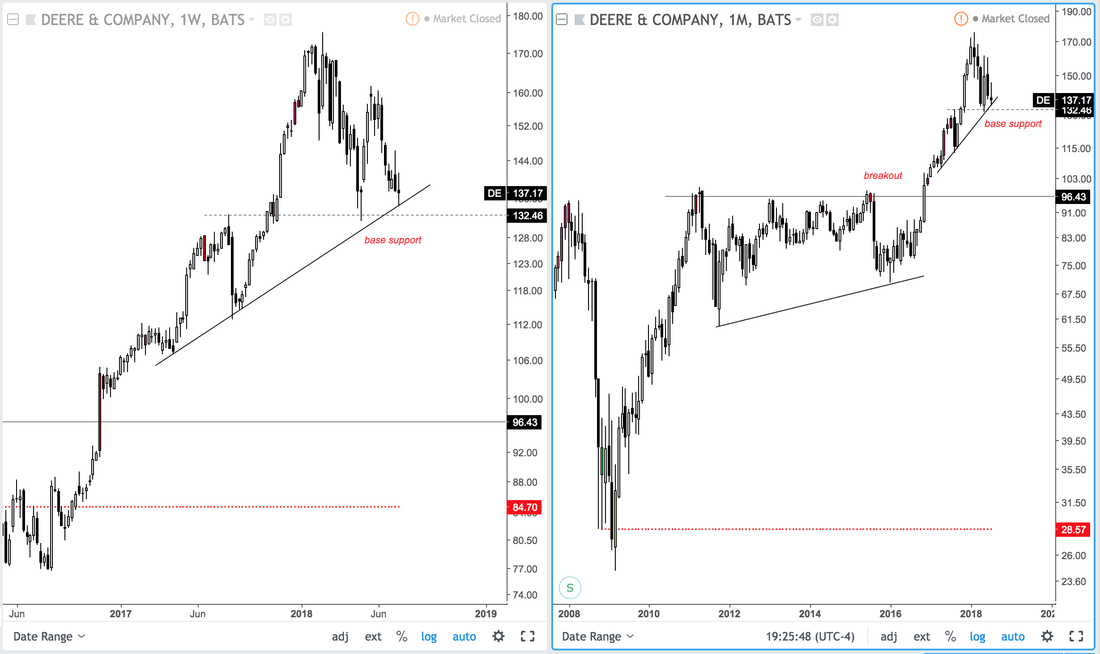

The massive sell-off in grains is slowing, which could offer relief for traders experiencing whiplash from volatility. Long-term charts show attractive support zones for wheat, corn, and soybeans with trend-lines covering nearly two decades of extreme price lows. Investors will likely find better long opportunities in wheat and corn as individual stocks such as Deere & Company (DE) trade near critical support levels. Wheat holds above base support The monthly chart of wheat futures shows a confluence of support from the early 2000's which should help prices recover from the 2013-2017 sell-off. Further, despite recent headline risk, wheat prices maintained buyer interest, evidenced by a positive increase in managed money positions as of the July 17 COT report. As buyers return, wheat prices are leading the overall counter-trend recovery in grains based on one-month relative performance. Soybeans counter-trend bounce likely The price recovery in soybeans should continue towards the 9.70 trend-break area from earlier this year. A critical break of a nearly two decade long trend of rising price lows is important, and could keep sellers active as the recovery matures. Trading towards a re-test offers an attractive reward-to-risk as a tactical counter-trend opportunity, especially given extreme bearish sentiment. Corn defends support zone Holding above 3.00-3.35 is important for corn futures, which struggled to maintain higher price lows from 2015. The recovery is muted, albeit with a gradual build in momentum. Prices still register overbought signals, so expect some choppy moves before a return towards the 4.00 level. Counter-trend bounce in Agriculture ETF DBA holdings consist of a mix of agriculture, concentrated in grains, which includes a 14.15% weight in soybeans, 11.88% in wheat, and 9.87% in corn. As a result, the counter-trend bounce in DBA resembles the chart pattern in soybeans. Daily and monthly charts below show a short-term recovery from the break-down zone with improving momentum and oversold levels. A recovery towards 17.84 and 18.20 appears likely. Deere & Company (DE) at key support DE marked an impressive breakout in 2017 and continued to hold a series of price lows into 2018. Currently, 132.46 represents an important support zone from a year long base and up-trend. Negative momentum is a concern, which means traders will need to wait for confirmation of a price close above last week's range. A breakdown below support in DE and continued bearishness in grain futures would negate a near-term bull case. |

AuthorDamanick Dantes, CMT Archives |

RSS Feed

RSS Feed