|

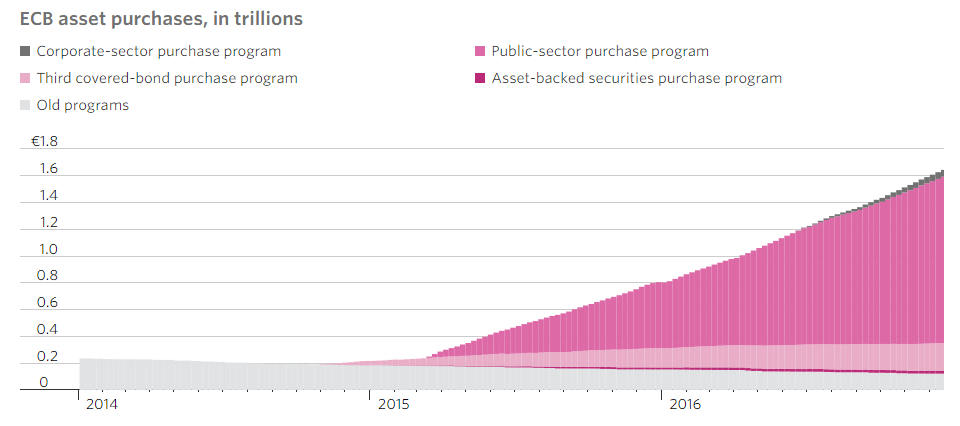

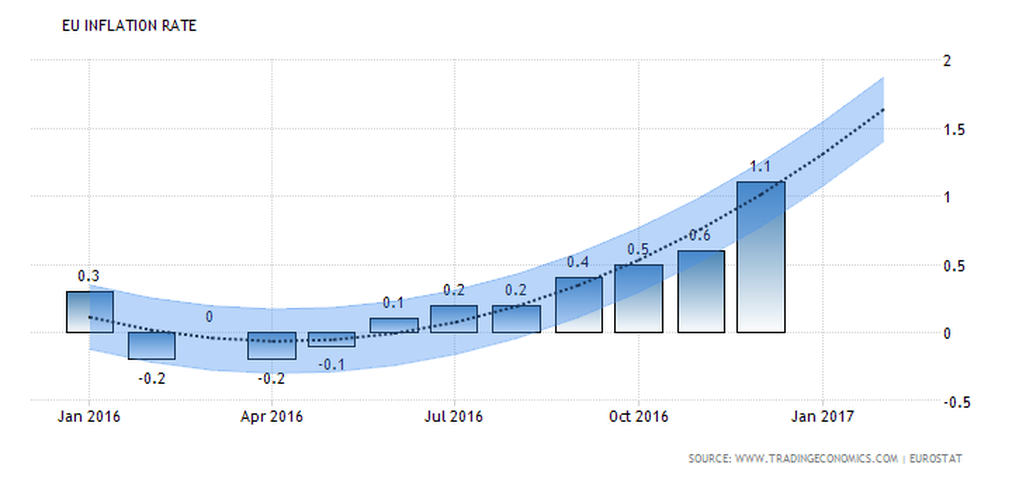

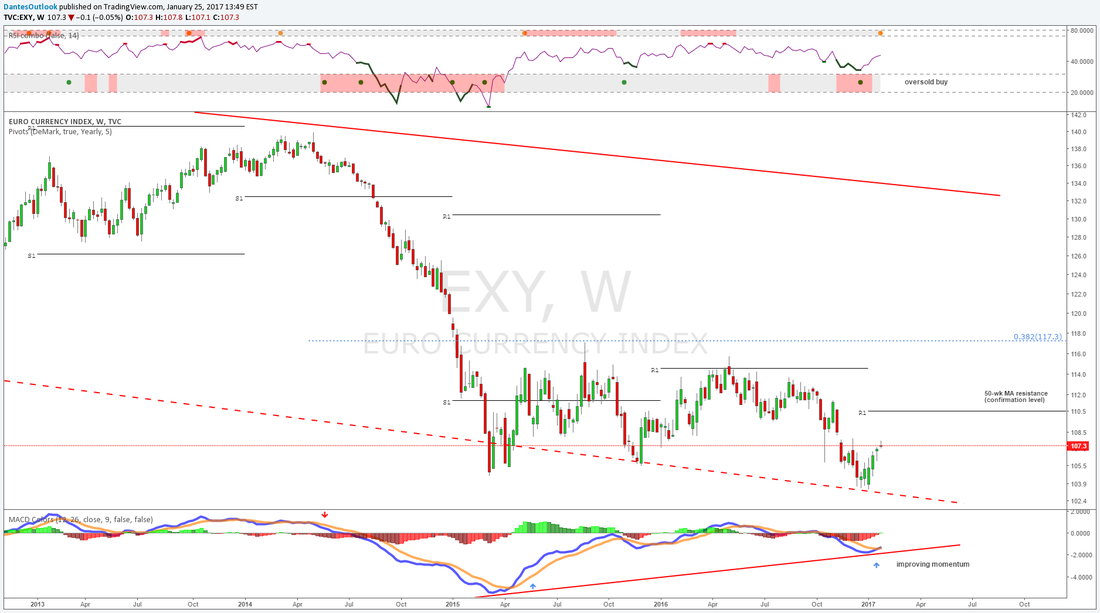

Manufacturing growth and pricing power could force the European Central Bank (ECB) to taper a vast monetary stimulus program. Sabine Lautenschläger became the first ECB board member to indicate a potential end to quantitative-easing (QE), according to a WSJ article. Improving economic data will shift attention to a post-QE Euro-zone, which will trigger market volatility and lift the Euro currency from oversold levels. Euro-zone manufacturing is in a steady expansion phase, evidenced by strong momentum in new orders and employment. Import prices were higher in the flash January Purchasing Manager's Index (PMI), driven by a depreciating Euro currency and rising commodity prices. The expansion is likely in the mid-stage as signs of service growth and inflation begin to surface. France posted strong PMI growth ahead of the April election with gains coming from the service sector. On the inflation front, Euro-zone suppliers posted greater pricing power. The mix of manufacturing and pricing strength encourages inflation rate forecasts towards the 2% level in 12-18 months time. The ECB asset buying program is intended to weaken the currency, boost stocks and lower financing costs. Expect a reversal in flows, which will trigger volatility as the program phases out. Flows will mostly appear in currency and rates, which should offer confirmation of the pending post-QE Euro-zone environment. In this scenario, Euro Bund Futures remain in focus, which registered a long-term bearish divergence based on declining relative strength from 2015. However, the recent back-up in yields triggered oversold sentiment on shorter time frames for Euro Bund Futures. A break below the 20-month moving average will provide confirmation that a new trend in rising yields will persist. The Euro currency index registered an oversold buy signal based on relative strength measures. An unwind of Euro-zone QE will force currency shorts to cover positions, which will fuel momentum to the upside. A cluster of minor resistance levels will need to confirm upside potential, similar to an inverse of the Euro Bund Futures chart above.

1 Comment

|