|

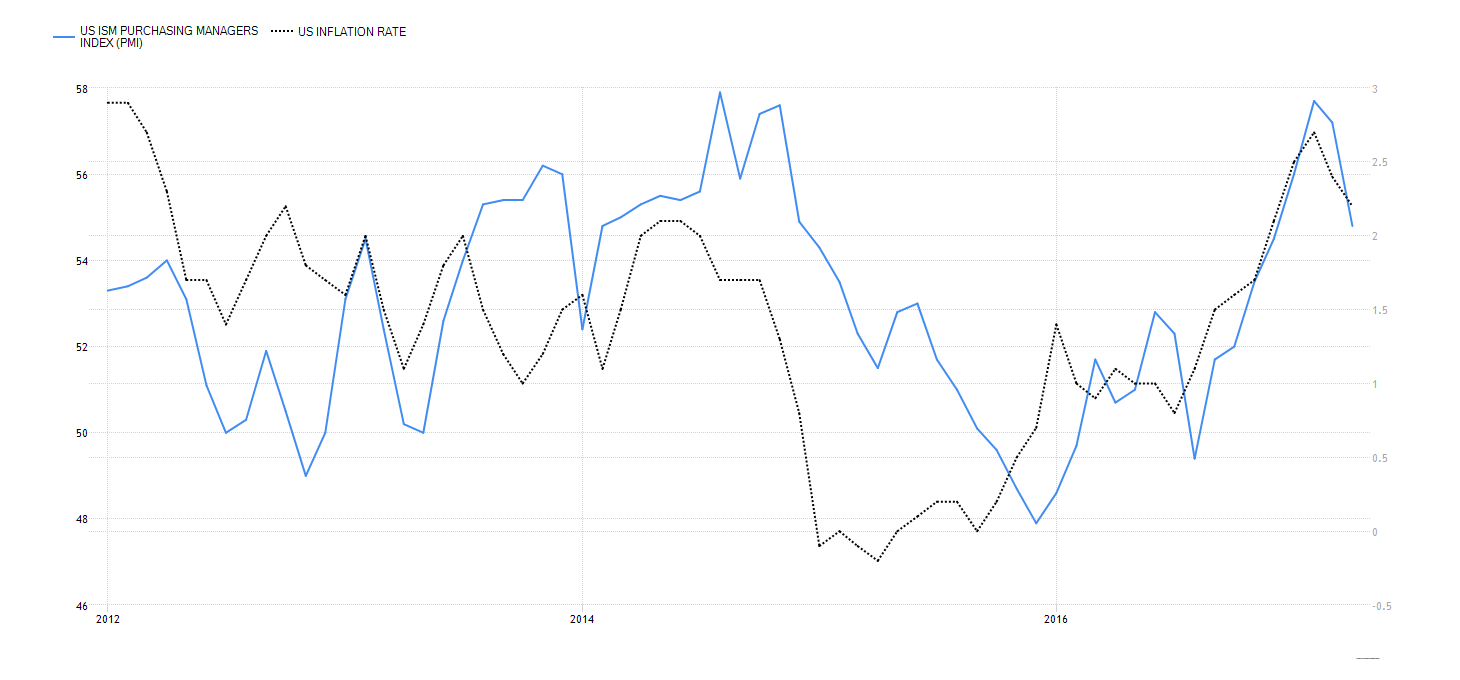

U.S. stocks advanced above the $2,400 level, which maintains long-term trend signals. Meanwhile, the pace of U.S. economic growth is slowing as inflation and manufacturing data are weaker. Furthermore, employment and new orders are expanding at a slower pace this year. The U.S. Dollar and Treasury yields are sensitive to slowing macro conditions, while post-election euphoria continues for equities as investors reach for risk exposure. This divergence confirms the base-case for hedging equity appreciation with gold and increased exposure outside of the U.S, particularly within the FX space as the Euro and British Pound complete a lengthly base accumulation. Upside appears limited for the U.S. Dollar given the bearish cross of the 50-day moving average below the 200-day moving average. A declining trend this year is intact, which supported an overbought downturn in Treasury yields and a sustained bid for Gold. This underlying safety bid is connected to slowing macro conditions despite the broader risk-on trend in equities.

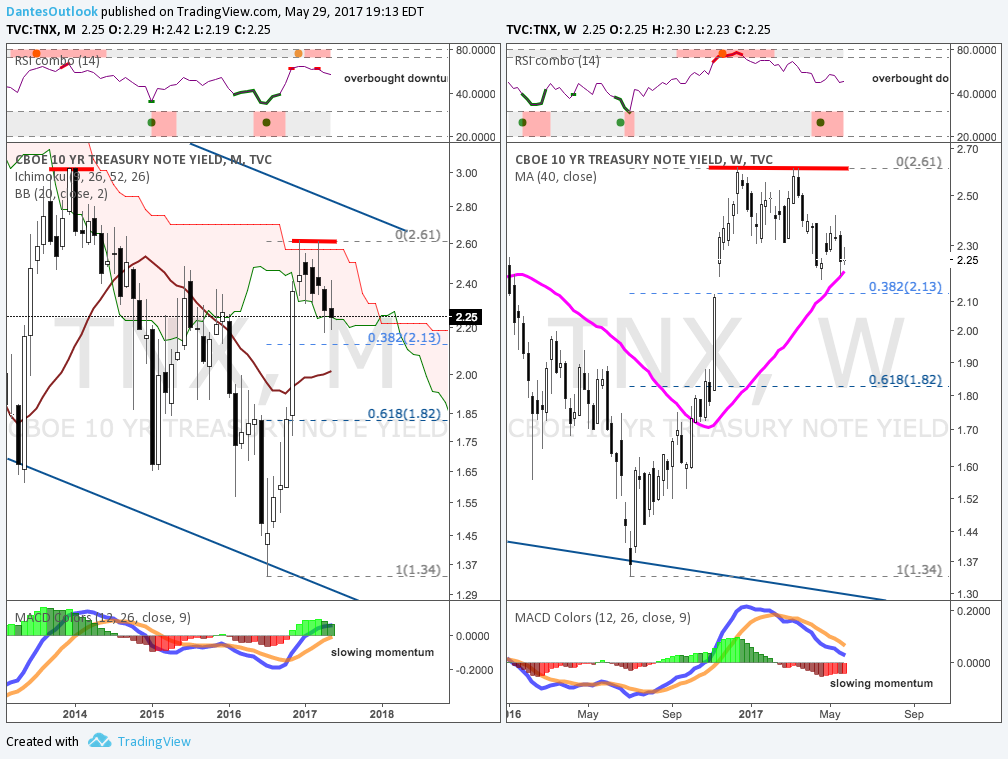

Finally, the U.S. election bond sell-off registered a familiar chart pattern seen during the "taper-tantrum" of 2014. A spike in Treasury yields also appears limited to a long-term declining trend line at the 2.60% level. The 10-year Treasury yield faces slowing momentum on the left monthly chart with more important support at 2.00%. However, on a weekly basis, the right panel chart shows near-term trend support around 2.30%.

0 Comments

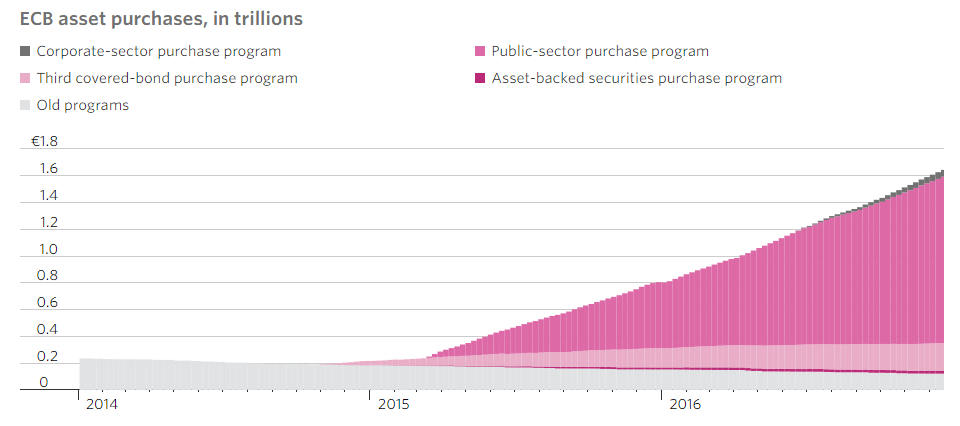

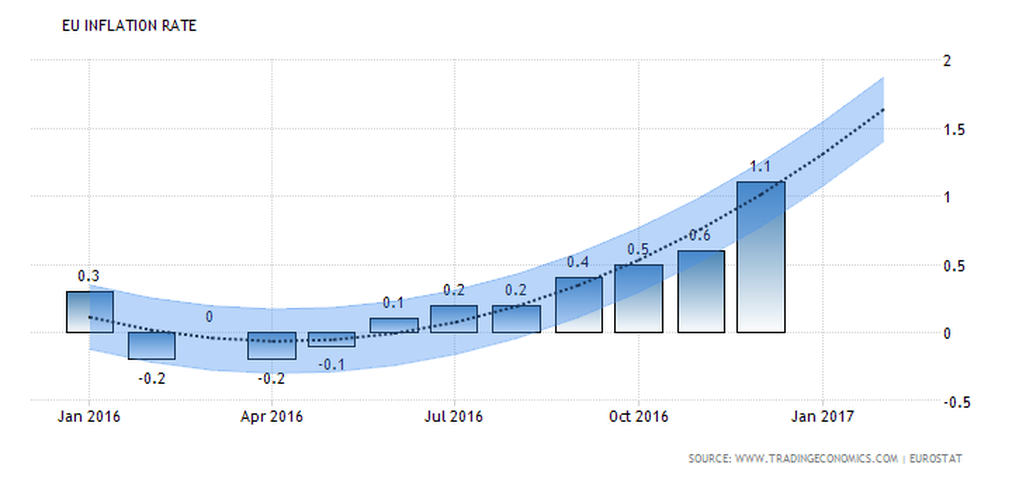

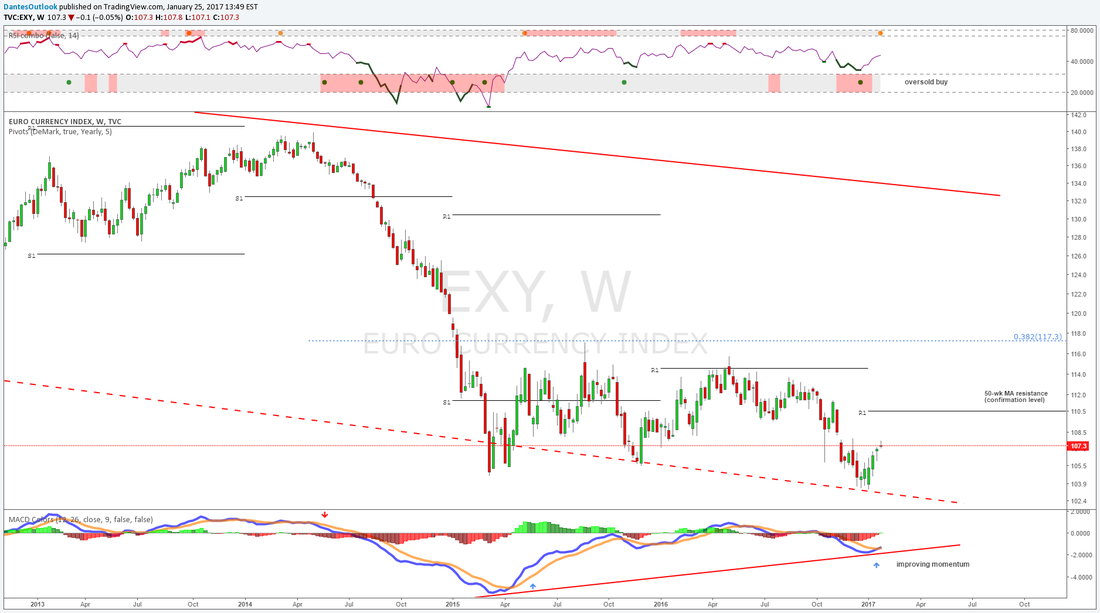

Manufacturing growth and pricing power could force the European Central Bank (ECB) to taper a vast monetary stimulus program. Sabine Lautenschläger became the first ECB board member to indicate a potential end to quantitative-easing (QE), according to a WSJ article. Improving economic data will shift attention to a post-QE Euro-zone, which will trigger market volatility and lift the Euro currency from oversold levels. Euro-zone manufacturing is in a steady expansion phase, evidenced by strong momentum in new orders and employment. Import prices were higher in the flash January Purchasing Manager's Index (PMI), driven by a depreciating Euro currency and rising commodity prices. The expansion is likely in the mid-stage as signs of service growth and inflation begin to surface. France posted strong PMI growth ahead of the April election with gains coming from the service sector. On the inflation front, Euro-zone suppliers posted greater pricing power. The mix of manufacturing and pricing strength encourages inflation rate forecasts towards the 2% level in 12-18 months time. The ECB asset buying program is intended to weaken the currency, boost stocks and lower financing costs. Expect a reversal in flows, which will trigger volatility as the program phases out. Flows will mostly appear in currency and rates, which should offer confirmation of the pending post-QE Euro-zone environment. In this scenario, Euro Bund Futures remain in focus, which registered a long-term bearish divergence based on declining relative strength from 2015. However, the recent back-up in yields triggered oversold sentiment on shorter time frames for Euro Bund Futures. A break below the 20-month moving average will provide confirmation that a new trend in rising yields will persist. The Euro currency index registered an oversold buy signal based on relative strength measures. An unwind of Euro-zone QE will force currency shorts to cover positions, which will fuel momentum to the upside. A cluster of minor resistance levels will need to confirm upside potential, similar to an inverse of the Euro Bund Futures chart above.

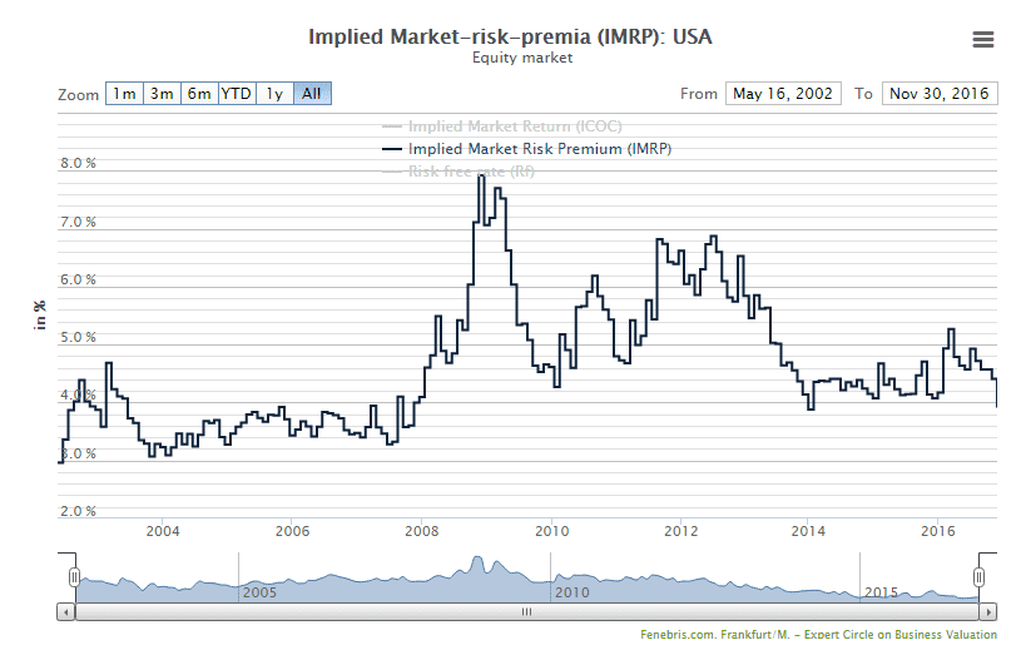

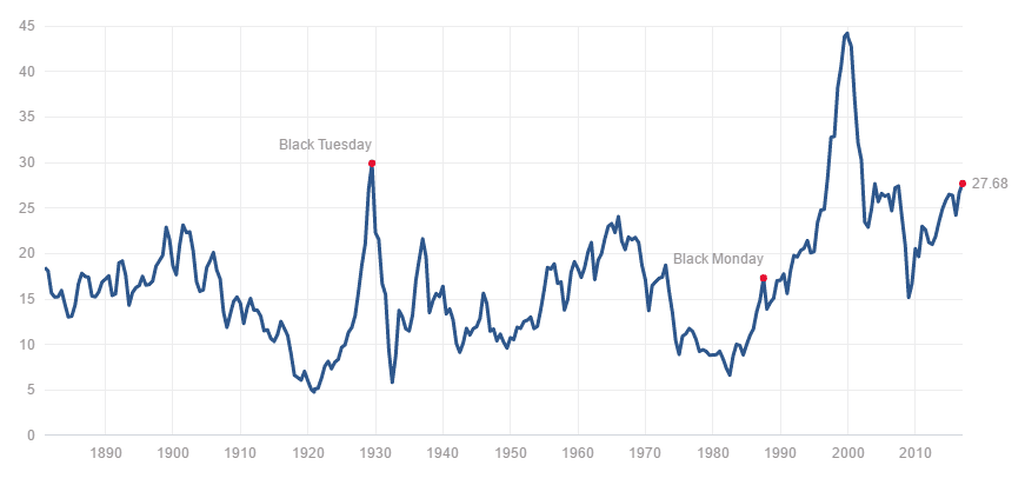

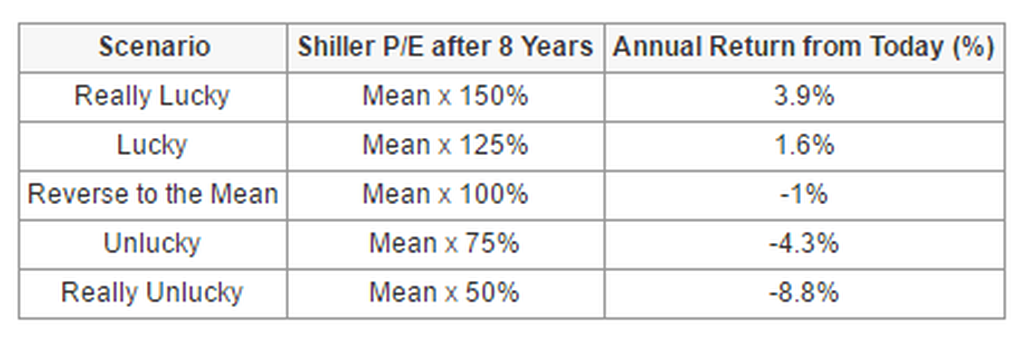

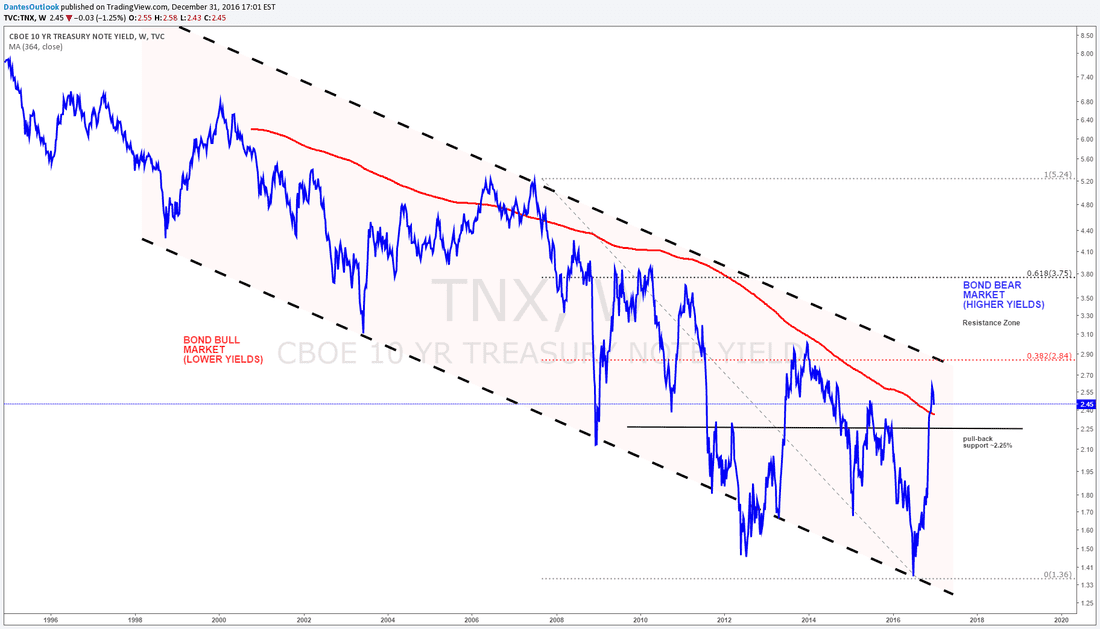

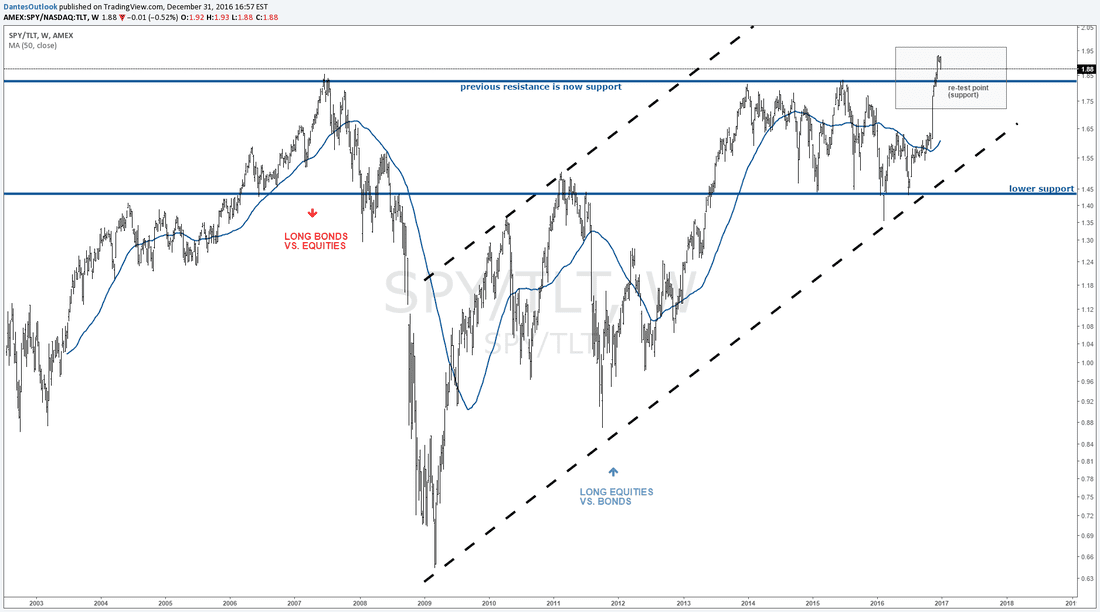

Welcome to 2017. Expect market volatility to creep higher into the New Year as investors take profit. I am positioned for a rise in long-duration Treasury bonds, which appear extremely oversold near a support zone. My current holdings are starting to reflect the base-case of complacency along a cycle shift. I begin with a look at the implied market risk premium, which was mentioned by Bundesbank VP Claudia Buch in a November '16 interview. Buch stated that a low ERP reflects a false sense of security that is tied to a period of prolonged monetary easing. The combination of stretched U.S. equity valuations and several indicators of complacency results in a bullish outlook on Gold and international equities vs. government bonds. Click on charts to expand view Markets do not reflect underlying risk The decline in equity risk premium reflects a false sense of security. The ERP measures the expected return that equity investors demand over and above a risk-free rate. Some argue the Federal Reserve engineered a declining ERP; enhanced by prior deflationary forces such as the decline in both commodity prices and government bond yields. Such complacency will likely trigger a greater risk premium as Western economies shift from a period of monetary easing to monetary tightening. For example, long maturity loans issued by European banks at such low rates is a concern. Banks will have to pay higher funding costs as short-term rates rise, which narrows the interest margin. The observation by Bundesbank VP Claudia Buch helps us understand the shifting rate cycle, which could be the starting point of a significant unwind of risk. U.S. Equity valuations are stretched A high level of complacency is also reflected in stretched valuation levels. The Shiller P/E ratio is around 60% higher than fair value, and recently exceeded 2007 levels. Shiller P/E is a valuation metric calculated by price dividend over an average of the past ten years of earnings, adjusted for inflation. Stretched valuation levels suggests a low to negative implied future annual return for U.S. equities. Treasury bonds oversold as yields hit resistance 'Equity Bulls' and 'Bond Bears' will continue to take profit into the new year. Investors should come to terms with long-term impacts of a shifting monetary cycle. A rally in long duration Treasury bonds from extreme oversold levels should slow the spike in yields. The chart below shows the 10-year Treasury yield at a key resistance zone. U.S. Equities preferred vs. long-duration Treasury bonds A short-term rise in bond prices does not warrant a sudden shift away from equities. The breakout in the S&P 500 relative to long-duration Treasuries will likely re-test support at the start of 2017 and continue an uptrend.

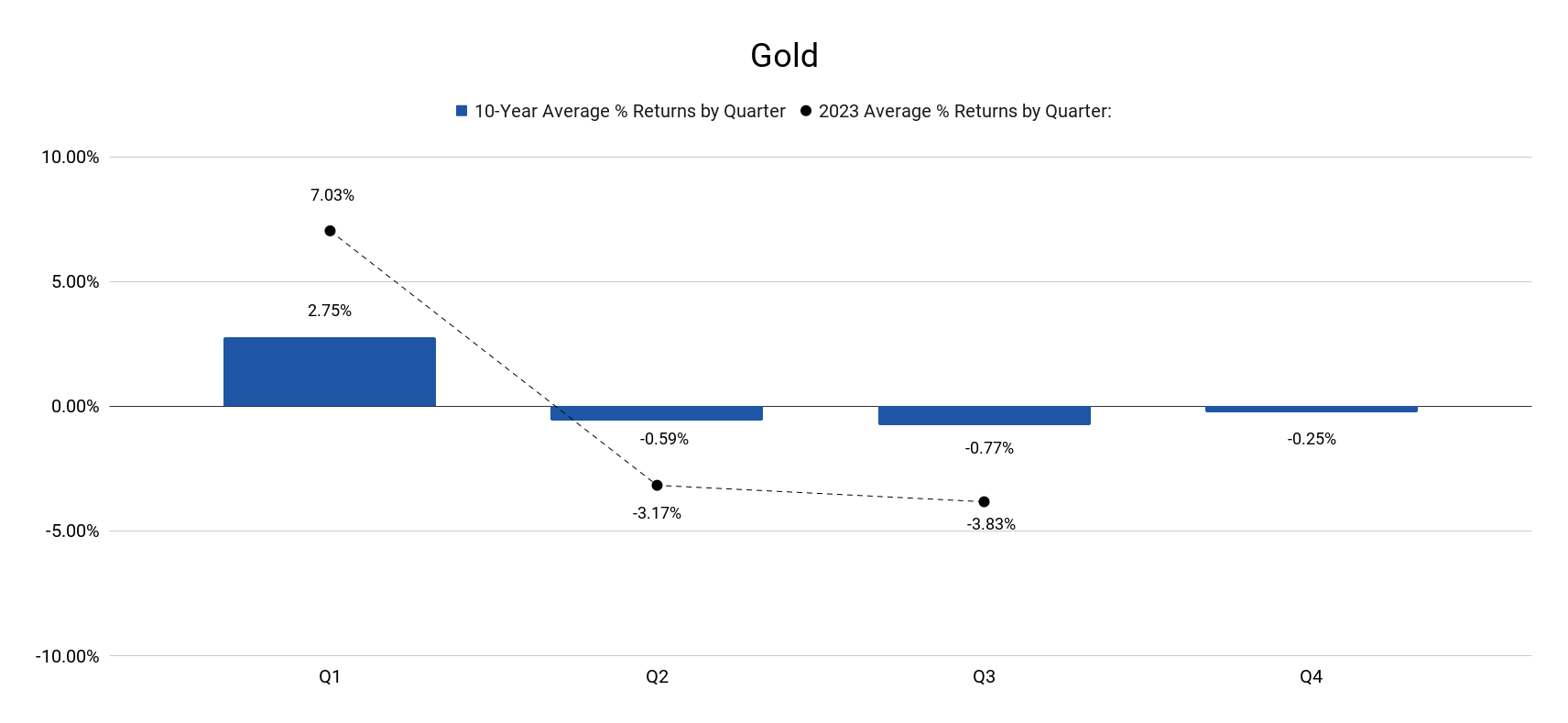

Hedge with Gold - further upside ahead The final result is a bullish outlook for Gold. An expected rise in market risk premium will trigger a re-pricing of risk assets into a cycle shift. Gold provides an alternative as both bonds and equities remain distorted from a prolonged period of monetary easing. The chart below shows the Gold price positioned at a key support level. If confirmed, a strong upside wave will follow. This is expected as the U.S. Dollar begins a downside corrective phase. With gold as a hedge, the hunt for attractive equity valuation will begin abroad. |