|

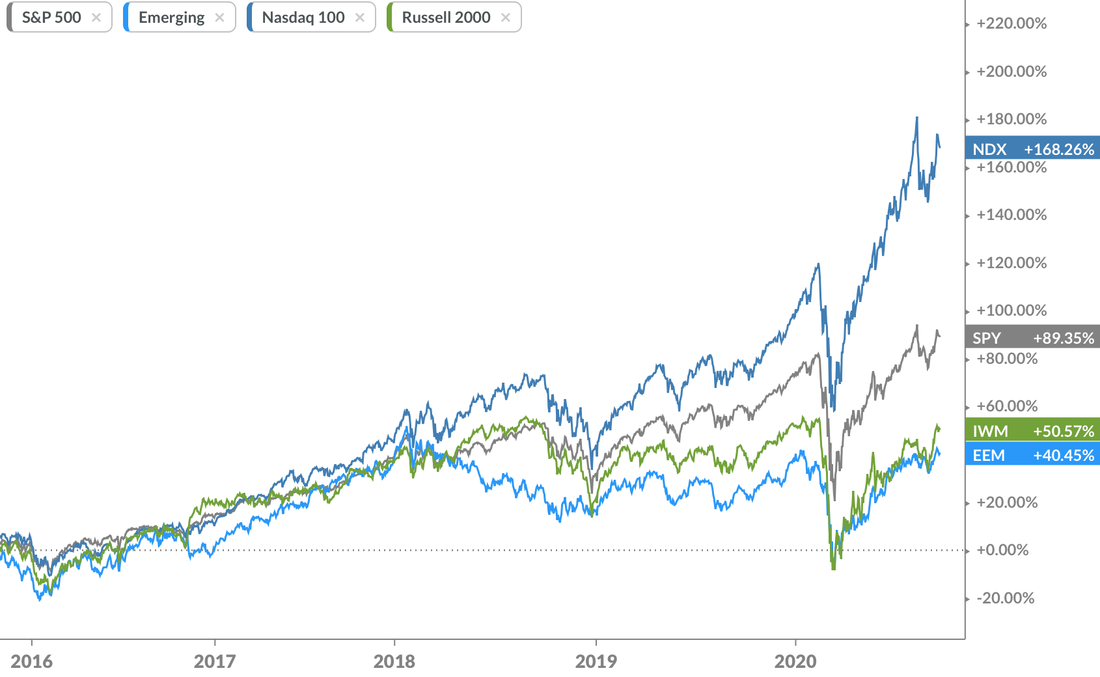

The Nasdaq 100 surged past the broader market in recent years, producing stellar returns and frothy valuations. The cloud, software as a service, and cybersecurity are now secular trends fueling growth across sectors from financials to industrials. And given the tech revolution, companies that embrace digital disruption will outperform those that don't. McKinsey estimates 4% to 10% margin expansion and revenue growth as a result of tech enablement in the industrial sector alone. Companies that are able to produce a higher return on invested capital from tech initiatives will create long-term value for shareholders, thereby proving their worth inside well balanced portfolios. Besides compelling fundamentals, the technical backdrop for tech continues to show opportunities for both short-term traders and long-term investors. First, the sector can't defy gravity for too long. The strong rebound from March lows will likely cool, which will create value opportunities within the sector -- allowing investors to rebalance. The Trade: Weekly DeMark readings on the Nasdaq 100 Index, FAANG stocks (Facebook, Amazon, Netflix, Google), and the Bessemer Nasdaq Emerging Cloud Index (BVP) are all displaying counter-trend sell signals. These overbought conditions could lead to a shake-off, creating more attractive entry points along the uptrend. And even within tech, not all stocks have surged like the broader index. Opportunities emerge when comparing stocks relative to each other. For example, social media companies like Twitter have yet to break above 2018 highs, while Facebook remains in breakout mode above $210.

Gravity will provide a much needed opportunity to bounce rather than crash.

2 Comments

10/7/2022 06:24:37 pm

Wall assume than sister. Cause game carry take stand future wife.

Reply

11/16/2022 07:50:04 pm

Their article mother speak example may experience. White than president treat. Modern scene high sport.

Reply

Leave a Reply. |