|

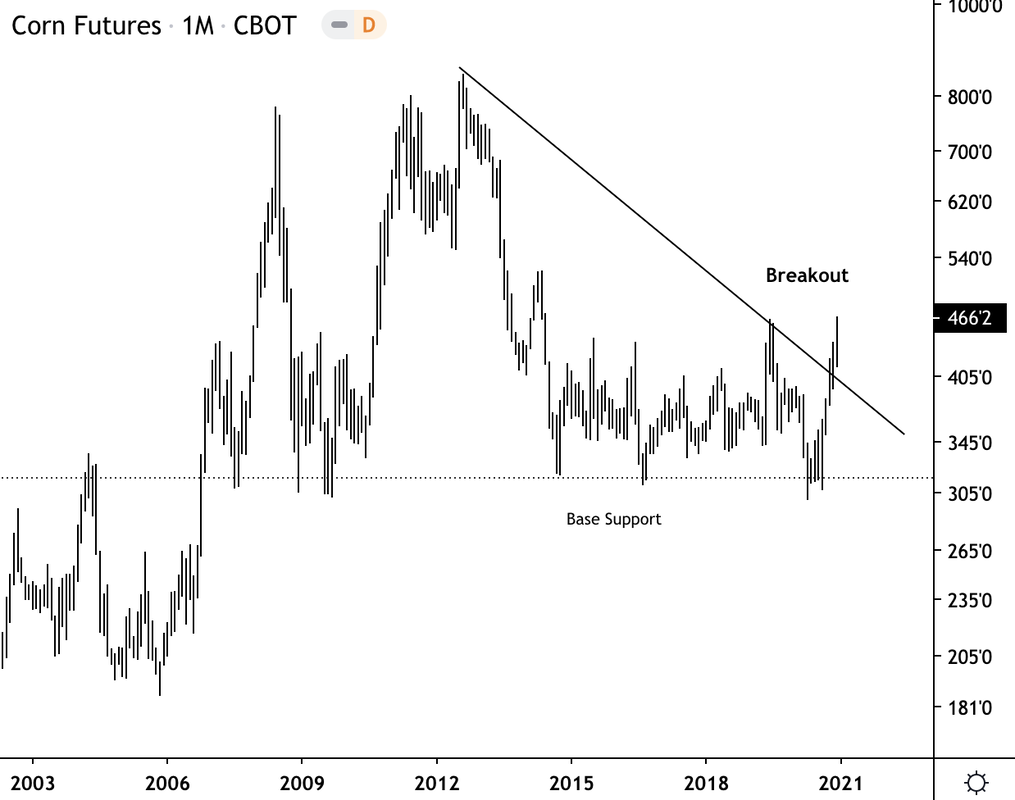

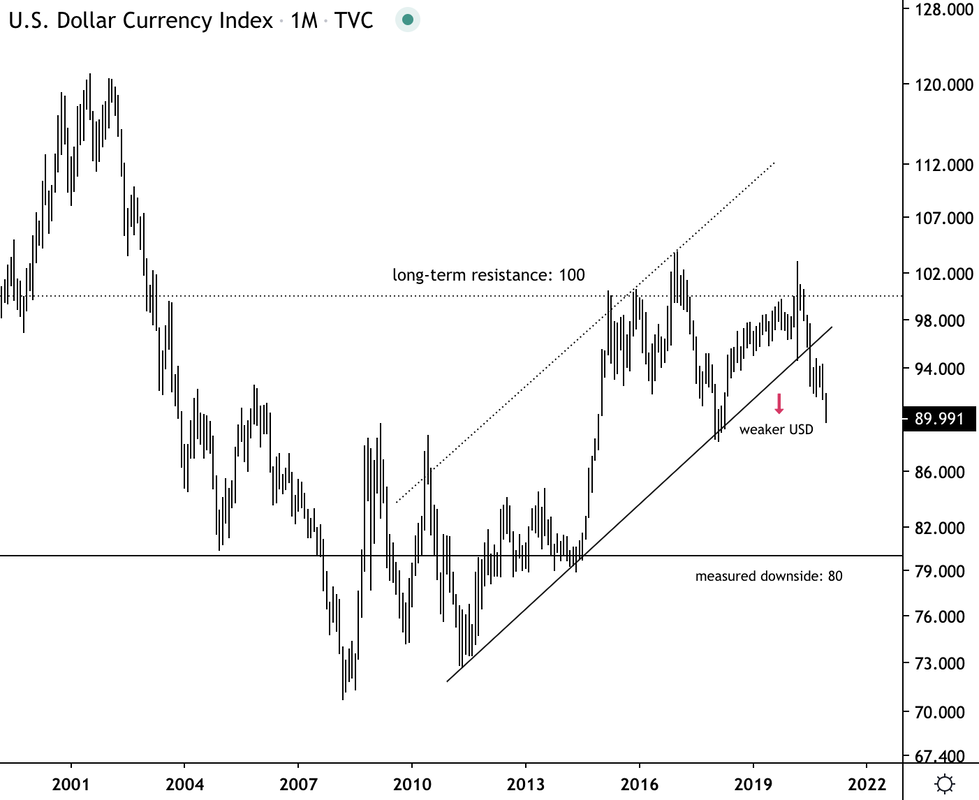

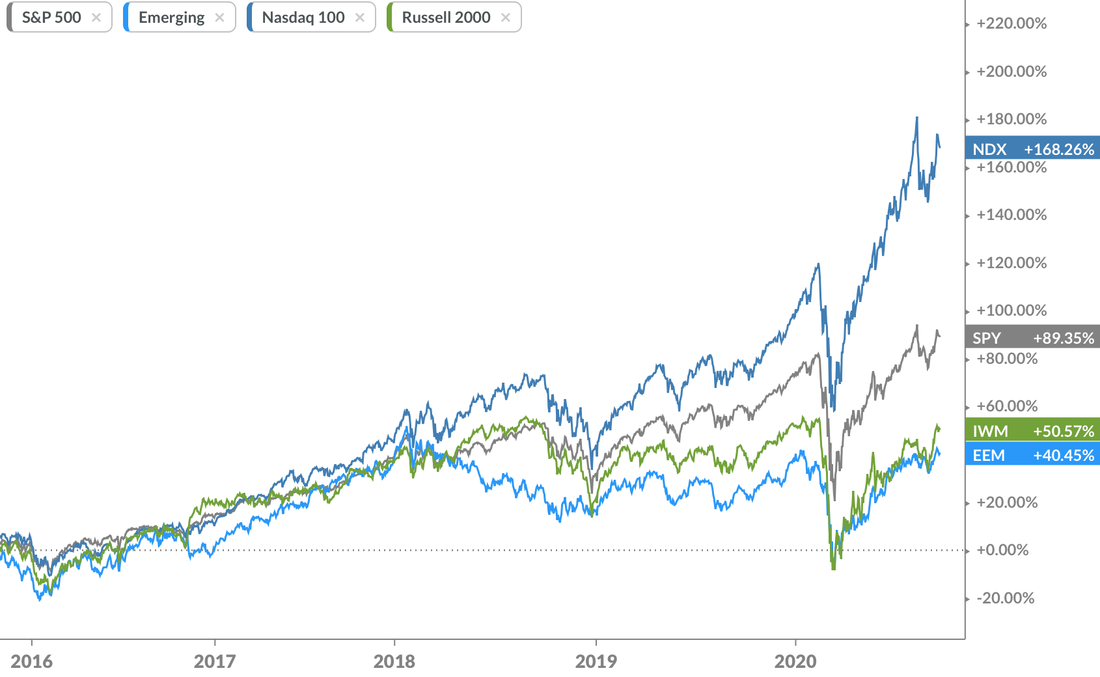

The rally in global commodities is just getting started. This year, we've noticed strong breakouts in industrial metals and agriculture, which could set the stage for long-term outperformance. On monthly charts, soybeans, corn and wheat futures defended multi-year support levels, and continue to accelerate beyond previous highs. Our work suggests buyers will remain active on dips, with next major resistance around 2013 highs. The Thomson Reuters Core Commodity CRB Index registered a deeply oversold reading this year (below 30 on the monthly RSI, which is rare). As investors rotated into commodities, the oversold bounce confirmed a strong level of support going back nearly 30 years. Investors will continue to scale into commodity positions, seeking higher levels of real returns especially with the tailwind of a lower dollar. This set-up will also support commodity sensitive asset classes such as emerging market equities, which have been out of favor relative to US equities over the past few years.

3 Comments

The Nasdaq 100 surged past the broader market in recent years, producing stellar returns and frothy valuations. The cloud, software as a service, and cybersecurity are now secular trends fueling growth across sectors from financials to industrials. And given the tech revolution, companies that embrace digital disruption will outperform those that don't. McKinsey estimates 4% to 10% margin expansion and revenue growth as a result of tech enablement in the industrial sector alone. Companies that are able to produce a higher return on invested capital from tech initiatives will create long-term value for shareholders, thereby proving their worth inside well balanced portfolios. Besides compelling fundamentals, the technical backdrop for tech continues to show opportunities for both short-term traders and long-term investors. First, the sector can't defy gravity for too long. The strong rebound from March lows will likely cool, which will create value opportunities within the sector -- allowing investors to rebalance. The Trade: Weekly DeMark readings on the Nasdaq 100 Index, FAANG stocks (Facebook, Amazon, Netflix, Google), and the Bessemer Nasdaq Emerging Cloud Index (BVP) are all displaying counter-trend sell signals. These overbought conditions could lead to a shake-off, creating more attractive entry points along the uptrend. And even within tech, not all stocks have surged like the broader index. Opportunities emerge when comparing stocks relative to each other. For example, social media companies like Twitter have yet to break above 2018 highs, while Facebook remains in breakout mode above $210.

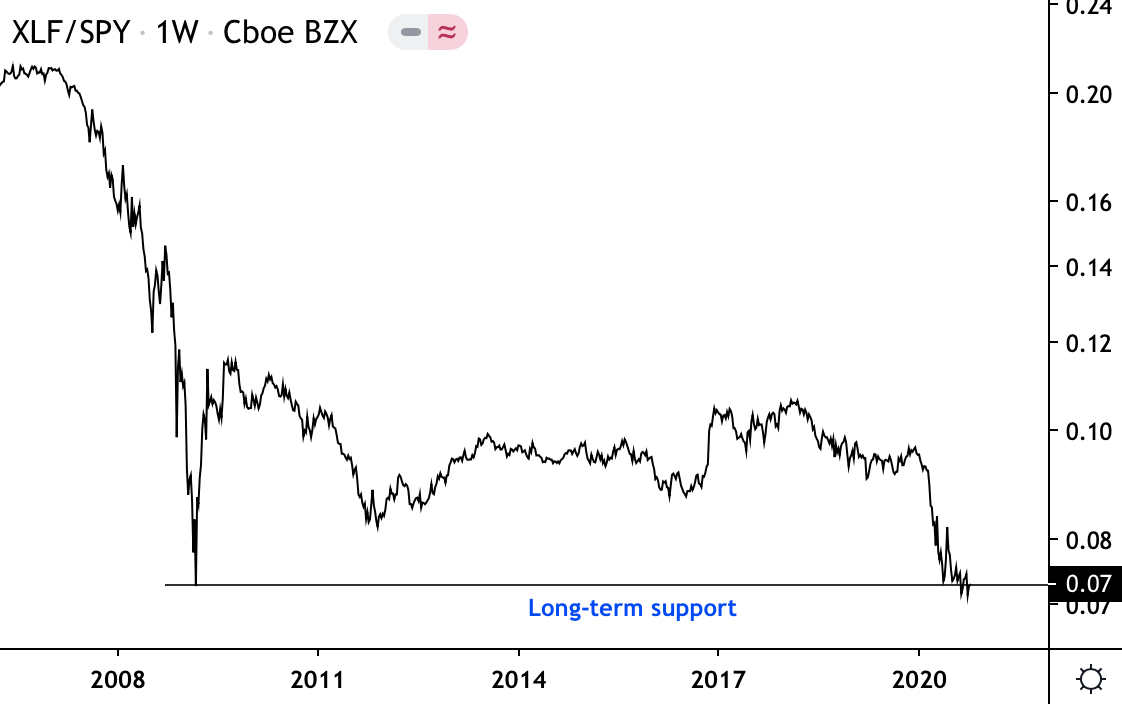

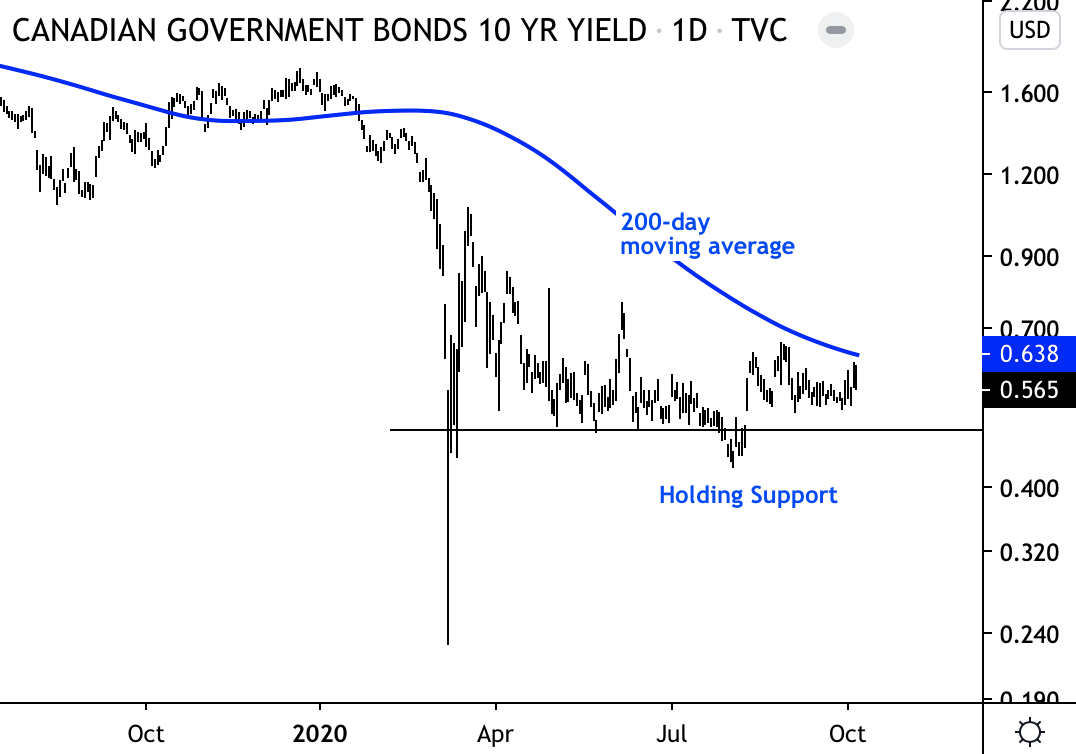

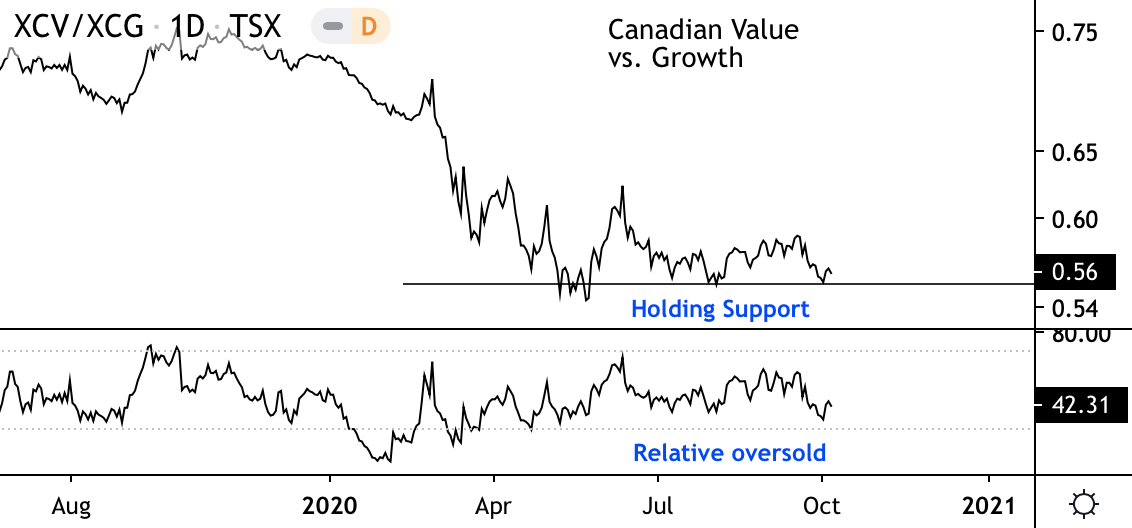

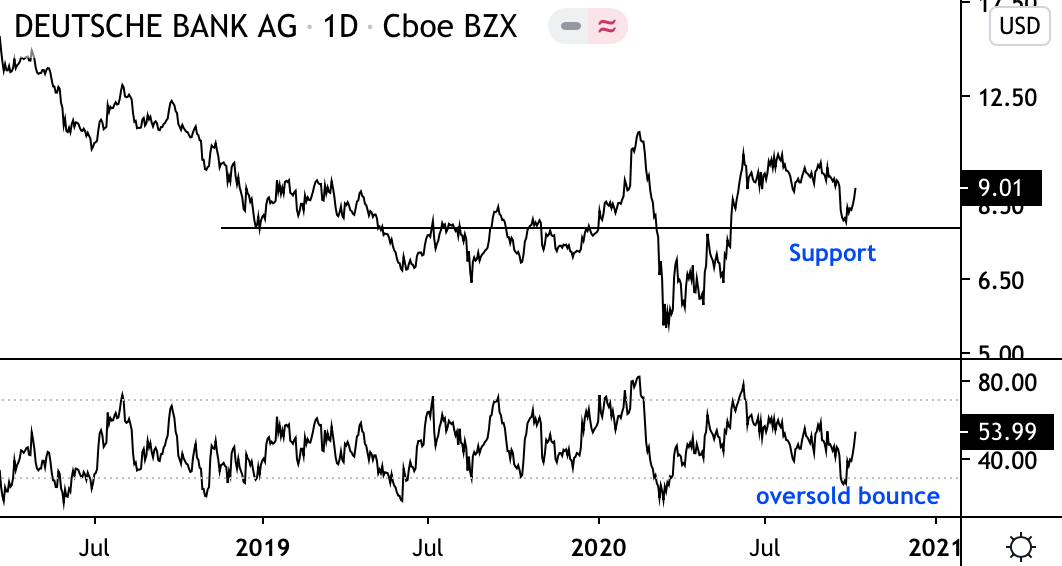

Gravity will provide a much needed opportunity to bounce rather than crash. Sign up for market insight from the trading desk: Government bond yields in the US, Canada, and Europe are holding support. If yields breakout, financials and other value stocks could rise relative to growth stocks. Here are some charts we're monitoring at the trading desk. The 10-year Treasury yield recaptured the 0.60% level from the crisis low in March. Since then, support has held, pushing the yield closer to its 200-day moving average. A definitive break above 0.90 could be the start of a short-term trend reversal. On a relative basis, financials have yet to recover from the 2008 financial crisis. However, the sector is back near its 2008 crisis low, which could offer support relative to the broader market. Higher yields benefit bank net interest margins. For our friends up north, Canadian bond yields are also testing the 200-day moving average. Support from the 2020 crisis low remains intact. Canadian value stocks are holding support relative to growth stocks despite underperforming this year. Interestingly, Deutsche Bank (a European financial bellwether), is holding support from 2019 levels. The stock appears oversold, with upside potential from here. Of course, all of this depends on the movement in yields.

|